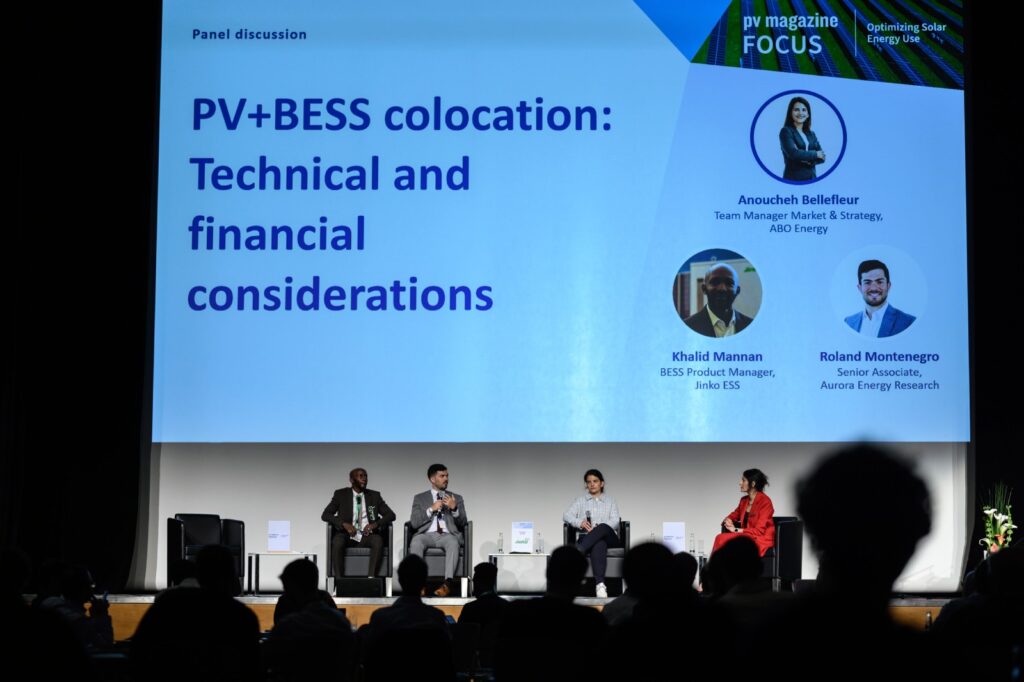

At pv magazine’s Focus event at Intersolar Europe this week, moderated by ESS News Editor Marija Maisch, the panelists discussed co-location and financing, alongside forward-looking presentations on market trends.

The integration of battery storage with solar was a central theme at pv magazine’s Focus 2025 event, where speakers tackled the technical and financial considerations of co-located systems. As batteries shift from grid support tools to revenue-generating assets, developers face trade-offs around configuration, control, and commercial strategy.

Storage Growth and Revenue Gaps

Presentation: Anna Darmani, Principal Analyst, Wood Mackenzie

Europe’s energy storage buildout is accelerating, according to Anna Darmani. By 2034, capacity could exceed 250 GW, with utility-scale projects making up half, up nearly 10-fold from today. This is driven in part by rising renewable penetration.

However, Darmani noted that revenue certainty still lags behind. Only about 2% of utility-scale projects in Europe operate under PPAs or tolling contracts, despite their value in reducing merchant risk. She expects this to change as the sector matures.

Fourteen EU countries now include energy storage targets in their 2030 plans, up from five in 2024, though targets vary between general and battery-specific goals.

Co-Location, Grid Access, and EMS Strategy

Panel: Anoucheh Bellefleur (ABO Energy), Roland Montenegro (Aurora Energy Research), Khalid Mannan (Jinko ESS)

The panel that followed focused on technical design choices for co-located projects. Bellefleur distinguished between co-located setups, where solar and storage operate separately, and hybrids, which share one inverter and operate jointly. This distinction affects everything from control systems to regulatory treatment.

Montenegro explained that in Germany, retrofitting batteries onto existing PV plants is common due to limited grid access. Adding storage to an existing connection can boost site value and avoid curtailment losses.

In a discussion, speakers agreed that AC vs. DC coupling decisions depend on site specifics and revenue mix and whether from arbitrage or ancillary services.

Bellefleur described batteries as fundamentally trading assets, offering either solar support or standalone income. Mannan stressed the role of energy management systems (EMS), suggesting that optimising EMS logic and using third-party analytics can significantly improve performance and availability.

An audience member raised a common hurdle: adding grid-charged storage to a hybrid plant often requires a new connection. Bellefleur said co-located systems may have an advantage here, with grid operators more likely to prioritise existing connections, prompting discussions of the quandries facing DSOs and TSOs.

Local Know-How, Global Supply

In a brief presentation between panels, Iñigo Atutxa Lekue of Cegasa called for more European involvement in battery storage. While battery cells are sourced almost exclusively from China, he said, much of the system-level value – electronics, controls, and O&M – can and should be handled in Europe, along with a stronger local skills base.

Battery Storage Offtake and Finance

Panel: Roberto Jiménez (BW ESS), Max von Hausen (Pexapark), Steffen Schülzchen (Entrix)

The final panel addressed financing models for BESS. Jiménez said that, pleasingly, capex has fallen for new batteries and bank appetite is growing, particularly where revenue is partially contracted.

Von Hausen noted that even pension funds are now looking at storage, but warned that only certain banks have the expertise to underwrite merchant-risk-heavy projects, especially in Germany, where there remains a reluctance in smaller, less international banks.

Entrix CEO Schülzchen said hardware is no longer the main challenge. Optimizing project revenues, whether through power purchase agreements, tolling, or merchant play, is now the bigger focus. A mix of these models is expected to dominate going forward, as financing strategies diversify alongside the market.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Source link