In a new weekly update for pv magazine, OPIS, a Dow Jones company, reports thatglobal polysilicon negotiations remain challenging, as buyers and sellers continue to struggle to reach agreements on pricing amid a persistent supply-demand imbalance. Furthermore, it reveals that China’s polysilicon futures market could imply a further 13% drop for Nov 2025 delivery contracts.

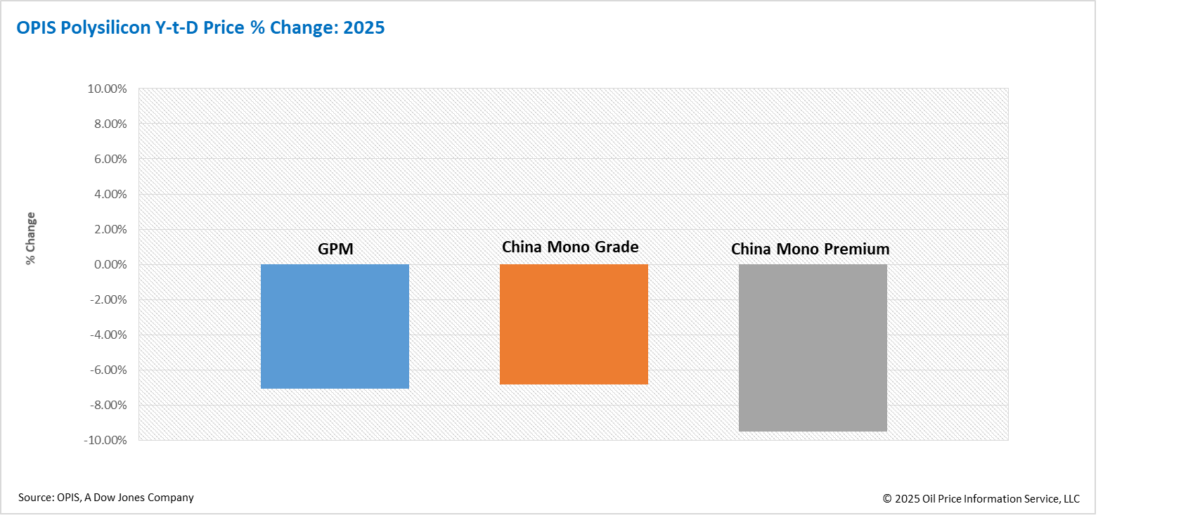

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon produced outside of China, was assessed at $18.917/kg or $0.040/W this week, reflecting a 1.64% decline based on reported buy-sell indications.

Global polysilicon negotiations reportedly remain challenging, as buyers and sellers continue to struggle to reach agreements on pricing amid a persistent supply-demand imbalance. According to market sources, monthly production of solar-grade polysilicon remains above 5,000 MT currently. Inventories are estimated at around 25,000 MT — a level sufficient to support approximately 12 GW of downstream manufacturing capacity.

A market participant confirmed that global polysilicon sales are currently heavily reliant on the execution of long-term contracts. However, fulfilling these agreements has become increasingly challenging, as exporting solar products to the U.S. is growing more difficult amid the complex and evolving trade environment. As a result, the source noted that production curtailments have emerged as a key strategy for suppliers seeking to manage inventory levels and stabilize the market.

In Southeast Asia, major buyers reportedly continue limited ingot production, in part to fulfill minimum purchase obligations under long-term supply agreements. One manufacturer noted that a portion of their wafer output and its associated downstream products has already been withdrawn from the U.S. market. Their current strategic focus for non-China-based production capacity has shifted toward the Indian market. This strategic redirection has indirectly weakened global polysilicon demand due to India’s ability to accept downstream products made with Chinese polysilicon.

Looking ahead, sources concur that additional price reductions may be the only viable solution to ease inventory pressure. Meanwhile, market concerns are mounting over the expected commercial launch of a new polysilicon facility in the Middle East early next year, which could exacerbate the ongoing global oversupply.

The China Mono Grade, OPIS’ assessment for mono-grade polysilicon prices within the country, remained stable this week at CNY 30.75 ($4.18)/kg, equivalent to CNY 0.065/W. The China Mono Premium, OPIS’ price assessment for mono-grade polysilicon used in n-type ingot production, declined by 3.06% week-on-week to CNY 35.625/kg, or CNY 0.075/W.

The price of China Mono Premium polysilicon has declined by 11.76% since its peak in the first week of April. According to market sources, some wafer producers have increased the use of downgraded polysilicon feedstock in n-type wafer production in an effort to reduce costs. As a result, sources indicated that a significant portion of the nearly 400,000 MT of polysilicon inventory consists of high-quality n-type material, while downgraded polysilicon suitable for n-type applications has largely been consumed.

At the same time, market sources noted that total polysilicon output in June may see a slight increase compared to May, reaching an estimated 110,000 MT. This anticipated rise is primarily driven by the resumption of operations at facilities in Yunnan and Sichuan, supported by the onset of the wet season and the resulting decline in hydropower costs. Although this uptick may be partially offset by reductions or temporary shutdowns at thermal power–reliant facilities, one source cautioned that the regional shift in production may not result in a fully balanced trade-off, potentially impacting overall supply levels.

Market participants generally expect continued weakness in the polysilicon spot market through the remainder of 2025, driven by persistent inventory pressures. This outlook is reflected in futures market trends. Data from the Guangzhou Futures Exchange on June 9 shows that settlement prices for June 2025 delivery stood at CNY36.660/kg, declining to CNY 31.865/kg for November delivery—marking a 13.08% drop over the period.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Source link